How Do You Calculate Weighted Average Using Fifo Method?

Cost Per Equivalent Unit– Fifo Method Vs. Weighted-Average Method

Keywords searched by users: How do you calculate weighted average using FIFO Weighted average vs fifo process costing, Weighted average method là gì, Comparison between fifo and weighted average method, Weighted Average Cost method là gì, Periodic weighted average method, Weighted average calculator, Advantages of weighted average method, Continuous weighted average cost method

What Is The Weighted Average Method Of Fifo Method?

The weighted average method and the FIFO method are two commonly employed techniques for inventory valuation. FIFO, which stands for “First-In, First-Out,” involves selling the oldest purchased goods first. In contrast, the weighted average method determines inventory value by calculating the average inventory levels. It’s important to note that FIFO is the more prevalent of the two methods, often used in inventory management. On the other hand, the utilization of the weighted average method is less common when compared to FIFO. This information was last updated on March 27, 2017.

Does Weighted Average Use Fifo Or Lifo?

Is the weighted average method based on FIFO or LIFO? This question often arises in accounting and inventory management. The choice between FIFO (First-In-First-Out) and LIFO (Last-In-First-Out) methods depends on various factors, such as price trends and the impact of inflation.

LIFO is typically favored when prices are on the rise, mainly due to factors like inflation. This preference arises because LIFO allows inventory costs to closely match the current market prices at the time of sale, providing a more accurate representation of the financial situation. On the other hand, FIFO is considered less favorable under these circumstances.

The Weighted-Average Cost method offers a middle ground between FIFO and LIFO. It calculates the average cost of inventory items based on both their purchase prices and quantities. This method does not rely on the specific order of purchases, making it a more balanced approach in scenarios where price fluctuations are significant.

In summary, while LIFO is the preferred method during rising prices, FIFO is less favored. The Weighted-Average Cost method offers a compromise between the two, allowing businesses to manage their inventory costs more effectively. Please note that this information is accurate as of April 15, 2021.

Can You Change From Fifo To Weighted Average?

Is it possible to switch from the FIFO (First-In, First-Out) inventory valuation method to the weighted average method? Yes, it is indeed possible. When a company decides to make this transition, it essentially shifts its fundamental approach to valuing inventory. The FIFO method relies on the specific cost flow assumption, where the oldest inventory items are assumed to be sold first. In contrast, the weighted average method calculates the value of inventory by taking into account the average cost of all the inventory items held at the beginning of the accounting period. This change not only impacts how a company assesses its inventory but also has broader implications for financial reporting and tax considerations.

Top 46 How do you calculate weighted average using FIFO

Categories: Found 84 How Do You Calculate Weighted Average Using Fifo

See more here: nhaphangtrungquoc365.com

Learn more about the topic How do you calculate weighted average using FIFO.

- Difference Between FIFO and Weighted Average

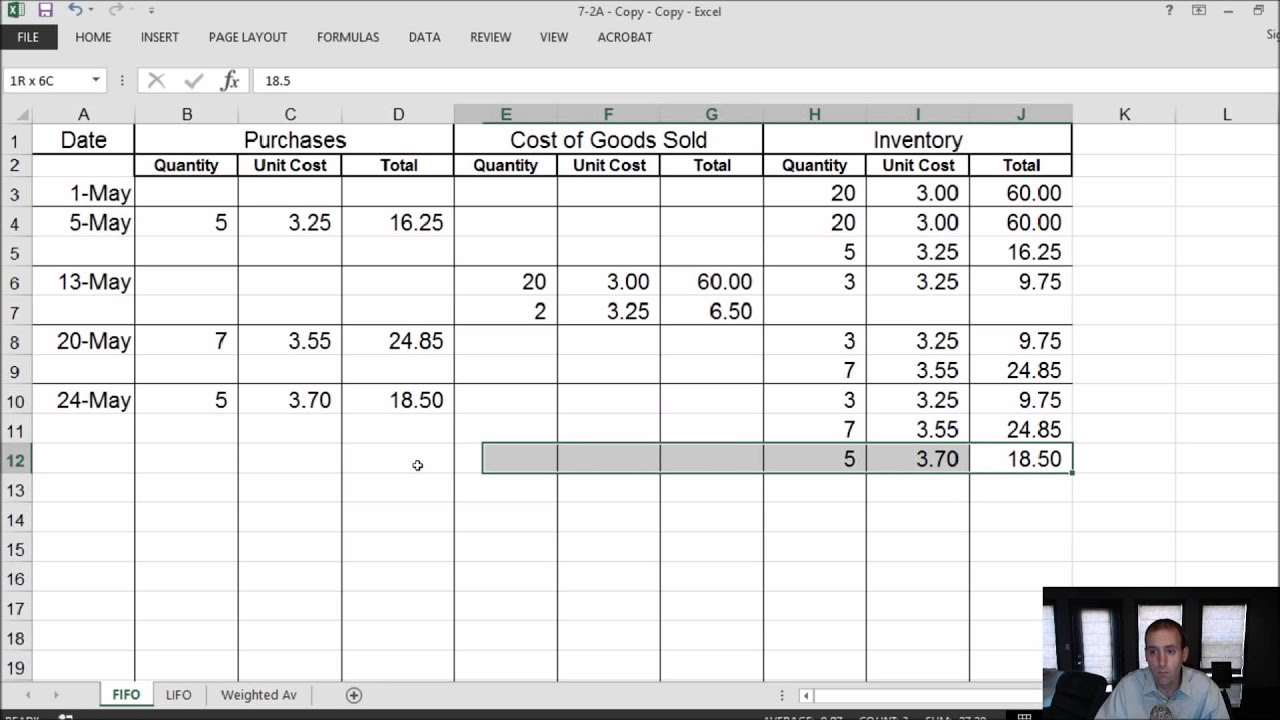

- Inventory Valuation | LIFO vs FIFO vs Weighted Average Cost

- Is change in inventory valuation method is a change in accounting …

- Inventory Valuation Methods: Specific Identification, FIFO, LIFO …

- Weighted Average: Formula & Calculation Examples

- Accounting – How to Calculate FIFO and LIFO – FreshBooks